Nebraska Inheritance Tax: A Brief Overview And Tax-Planning Opportunities

Nebraskans received some welcome news recently in the form of a reduction of the state inheritance tax rates and increased inheritance tax exemptions, effective for deaths occurring on or after January 1, 2023. (For more details, see our Tax Alert titled “Nebraska To Reduce Inheritance Tax Rates, Increase Inheritance Tax Exemptions In 2023.”) With these changes on the horizon, now is a good opportunity to review the fundamentals of Nebraska’s existing inheritance tax - including what it covers and, perhaps more importantly, doesn’t cover - and also discuss some possible strategies to help lessen its impact.

Overview of Nebraska Inheritance Tax Laws

Nebraska imposes an inheritance tax on a beneficiary’s right to receive property from a deceased individual (a “decedent”). With certain exceptions discussed below, Nebraska’s inheritance tax applies to all the assets owned by a decedent who is a Nebraska resident at the time of his or her death. It also applies to nonresidents who own Nebraska real estate or tangible personal property physically located in Nebraska.

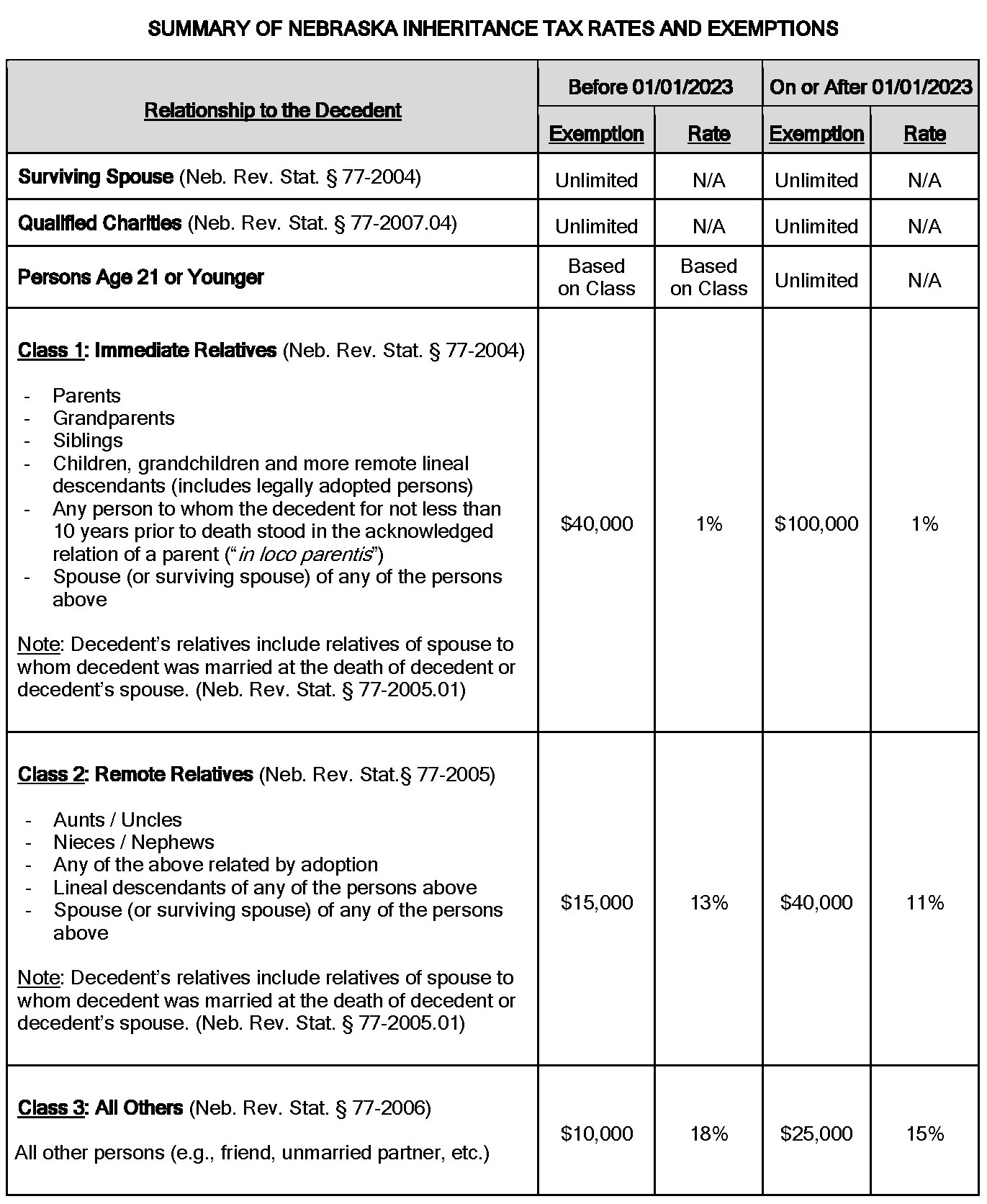

The amount of inheritance tax that must be paid, if any, is determined by two main factors: (1) the total value of the decedent’s assets received by a beneficiary; and (2) the beneficiary’s relationship to the decedent. Generally speaking, this tax structure tends to penalize transfers outside the decedent’s immediate family by applying higher tax rates and lower exemption amounts to such transfers. (See the table that follows this article for a summary of the applicable Nebraska inheritance tax rates and exemptions.)

Any inheritance tax due must be paid within one year of the decedent’s date of death. If the tax is not timely paid, then interest starts accruing at a rate of 14% per year. Late payments can also result in penalties of 5% per month (up to 25% maximum) of the unpaid tax.

Assets Exempt from Nebraska Inheritance Tax

Certain assets are fully exempt from Nebraska inheritance tax, including the following:

- Life insurance proceeds (except for any life insurance payable to the decedent’s estate);

- Real estate and tangible personal property located outside of Nebraska; and

- Money and property that immediate family members are entitled to under the homestead allowance, exempt property right and/or family maintenance allowance.

Other Excluded Transfers Not Subject to Nebraska Inheritance Tax

In addition to the list of exempt assets, there are also other types of transfers that are not subject to Nebraska inheritance tax. Such transfers include:

- Any assets transferred to the decedent’s surviving spouse;

- Any assets transferred to a qualified charitable organization or a federal, state or local governmental entity; and

- Gifts completed more than three years before the decedent’s date of death.

Strategies to Reduce the Nebraska Inheritance Tax

While it is not always possible to eliminate the impact of Nebraska’s inheritance tax, there are several strategies that may help reduce it with proper advance planning. A few of those strategies are discussed below.

Pre-Death Gifting

The general rule is that any assets that are gifted (or otherwise transferred for less than full fair market value) by the decedent within three years of the decedent’s date of death are subject to Nebraska inheritance tax. However, as noted above, gifts made more than three years prior to the decedent’s date of death are completely excluded.

Also excluded are gifts to any person that are made within three years of the decedent’s date of death, but only if such gifts were not required to be reported on a federal gift tax return (IRS Form 709). Hence, Nebraska inheritance tax should not apply to any “annual exclusion” gifts (currently, up to $16,000 per donee per calendar year) made by the decedent before the decedent’s death, since such gifts do not need to be reported on a Form 709.

These exclusions for certain pre-death gifts offer a potential planning opportunity to avoid or reduce Nebraska inheritance tax, as illustrated by the following examples:

Example 1: David wants to gift $200,000 to his favorite nephew, Norman. Assume David dies on December 31, 2022. If David’s estate plan includes a $200,000 cash bequest to Norman, payable upon David’s death, then such bequest will incur Nebraska inheritance tax in the amount of $24,050, calculated as follows: ($200,000 bequest - $15,000 exemption = $185,000) x 0.13 rate = $24,050 inheritance tax due.

Example 2: Assume the same facts as in Example 1, except that instead of a bequest payable to Norman upon David’s death, David decides to gift $200,000 cash to Norman while David is still living. As long as such gift is made more than three years before David’s death (i.e., on or before December 30, 2019), no Nebraska inheritance tax is due on the gift to Norman.

Example 3: Assume the same facts as in Example 1, except that instead of a bequest payable to Norman upon David’s death, David gifts $10,000 cash to Norman in each of the past 20 calendar years ($200,000 total). None of the pre-death gifts to Norman are subject to Nebraska inheritance tax.

It is important to keep in mind, however, that the Nebraska inheritance tax rates are generally much lower than the combined federal and state income tax rates. Thus, before any non-cash gifts are considered, the pros and cons of the proposed gifts should be fully analyzed, including whether the potential loss of income tax basis “step up” at the decedent’s death may result in overall higher taxes for the recipient after the decedent’s death.

Utilizing Valuation Discounts for Closely-Held Business Entities

If the decedent owned any interest in a closely-held business entity, such as a family-owned LLC or corporation, then the appraised value of the decedent’s interest in such entity may be determined, for inheritance tax purposes, at an amount that is lower than the product of: (1) the decedent’s percentage ownership; multiplied by (2) the fair market value of the entity’s net assets. This reduction in value (aka “valuation discount”) - which is commonly determined by a qualified independent appraiser hired by the decedent’s estate - is oftentimes based on the appraiser’s conclusion that the decedent’s interests were “non-controlling” (aka “minority” interests) and/or “non-marketable.”

A “non-controlling” ownership interest is usually worth less than a pro-rata share of a “controlling” ownership interest. This is because a minority owner does not have control over important business decisions like buying or selling assets, declaring dividends and determining compensation. To acknowledge this disadvantage, an appraiser can apply a discount for “lack of control” to the minority interest. A similar valuation discount - known as a “lack of marketability” discount - is a recognition of the business reality that outside investors are less willing to purchase minority interests in non-public, closely-held entities because of the obvious risk involved with such investments.

The good news is that these valuation discounts can be utilized to help lower the value of the decedent’s closely-held, minority business interests for transfer tax purposes. Similar logic should also apply in the case of any fractional ownership interest in Nebraska real estate that the decedent owned at death.

Planning for Nonresidents Owning Nebraska Real Estate

The general rule for nonresidents, including former Nebraska residents, is that only real estate and tangible personal property actually located in this state are subject to Nebraska inheritance tax. Intangible assets owned by nonresidents are not subject to Nebraska inheritance tax under most circumstances, since those assets are deemed to have a “tax situs” located in the home state of the nonresident.

For nonresidents that own Nebraska real estate, another tool used to avoid Nebraska inheritance tax is to form a separate legal entity, such as a limited liability company (LLC), to hold legal title to the real estate. By placing Nebraska real estate into an LLC, the real estate is no longer directly owned by the nonresident. Instead, the LLC holds the real estate and the nonresident owner is left with only an intangible property interest in the company, which should not be subject to Nebraska inheritance tax. Of course, this strategy will not be effective if the nonresident’s home state also imposes a comparable state death tax.

If you need any assistance with Nebraska inheritance tax planning, please contact a member of McGrath North’s Tax and Estate Planning Group.